Introduction to Security under the PPSA

Personal Property Registration

The Personal Property Security Act, R.S.O. 1990 c. P.10 (the “PPSA”), governs security

interests in personal property and provides for a system of registration of personal property

security interests in Ontario.

A. The PPSA System

The PPSA creates a centralized personal property registry system where registrations of security

interests governed by the PPSA may be recorded. Secured parties who wish to register their

security interest in the registry system do not file the actual security agreement. Secured parties

file a simple notice, known as a financing statement, which contains basic information about the

security agreement. 5 Once a secured party has registered a financing statement, the secured party

has 30 days within which to deliver a copy of the financing statement to the debtor pursuant to

section 46(6) of the PPSA. With the exception of security interests relating to consumer goods,

a secured party may register a financing statement either before or after the security agreement is

executed by the debtor. 6

Originally, the registration system was entirely paper-based. However, in all provinces,

including Ontario, the register is now computerized and accessed electronically. 7 Amendments

Anthony 1. Duggan & Jacob S. Ziegel, Secured Transactions in Personal Property 5th ed. (Toronto: Edmond

Montgomery Publications Limited, 2009) at 210.

D.J. Donahue, P.D. Quinn & D.C. Grandilli, Real Estate Practice in Ontario 6th ed. (Markham: LexisNexis

Canada Inc., 2003) at 186.

Anthony J. Duggan & Jacob S. Ziegel, Secured Transactions in Personal Property 5th ed. (Toronto: Edmond

Montgomery Publications Limited, 2009) at 211.

1 – 4to the Ontario legislation in 2006 eliminated the paper option and now all financing statements

are required to be in the electronic format approved by the registrar. 8

The financing statement sets out the names and addresses of the debtor and the secured party, a

description of the collateral, and the duration of the registration. 9 Registrants, however, must be

careful to follow the registration requirements contained within the PPSA and its regulations, as

any error may lead to the registration being invalid and ineffective. 10

Security interests are registered and searched against the debtor’s name, or, for motor vehicles,

security interests may also be registered and searched against the motor vehicle’s Vehicle

Identification Number (“VIN”). If the motor vehicle is a consumer good, then the financing

statement must set out the VIN; however, if the motor vehicle is equipment or inventory,

including the VIN is optional. As a result of the decisions in Lambert (Re) (In Bankruptcy),

1995 CanLII 3500 (ON C.A.), and Magna International Inc. v. Formulated Coatings Ltd., 2009

CanLII 29907 (ON S.C.), including the correct VIN in a PPSA registration with respect to a

motor vehicle is advisable. The current law in Ontario is that a correct VIN cures the error ofthe

incorrect debtor name in the financing statement. Further searching by VIN should be

undertaken where security is taken over motor vehicles.

Unlike searches relating to ownership of real property, there is no search that can be done under

the PPSA to confinn whether the person selling or charging interest in personal property is the

legal owner.

Anthony J. Duggan & Jacob S. Ziegel, Secured Transactions in Personal Property 5th ed. (Toronto: Edmond

Montgomery Publications Limited, 2009) at 212.

R.R.O. 1990, Reg. 912

10 The test for consideration of whether an error in a registration invalidates it is whether “a reasonable person is

likely to be misled materially by the error or omission” pursuant to section 46(4) ofthe PPSA.

1 – 5To have a valid security interest against collateral in favour of the secured creditor, the secured

creditor must establish each ofthe following:

(a) Security Agreement. A security agreement between the creditor and the debtor

with respect to the collateral at issue must be established.

(b) Attachment. The creditor needs to establish that it gave value, the debtor has

rights in the collateral and the evidentiary requirements of the PPSA (a security

agreement signed by the debtor in favour ofthe secured party which describes the

collateral).

(c) Perfection. The creditor needs to perfect its security interest. Part III of the

PPSA governs perfection and the required steps depend on the nature of the

collateral. Perfection is generally effected by registration of a financing

statemellt, possession ofthe collateral or cOl1trol ofthe collateral.

(d) Outstanding Obligation. The creditor needs to establish that there IS an

outstanding obligation owed by the debtor to it.

B. The basic priority rules

The basic priority rules are set out in section 30 of the PPSA. While a number of matters may

affect priority, the basic rule is that for security interests perfected by registration, priority shall

be determined by the order ofregistration regardless ofthe order of perfection. The effect ofthe

basic priority rule is that it is important to register the secured creditor’s financing statement as

soon as you can, so that a post registration certified search can be obtained before advancing

funds. While there are exceptions, generally if future advances are made while a security interest

is perfected, the security interest has the same priority with respect to each future advance as it

has with respect to the first advance.

Why Use Litman Law?

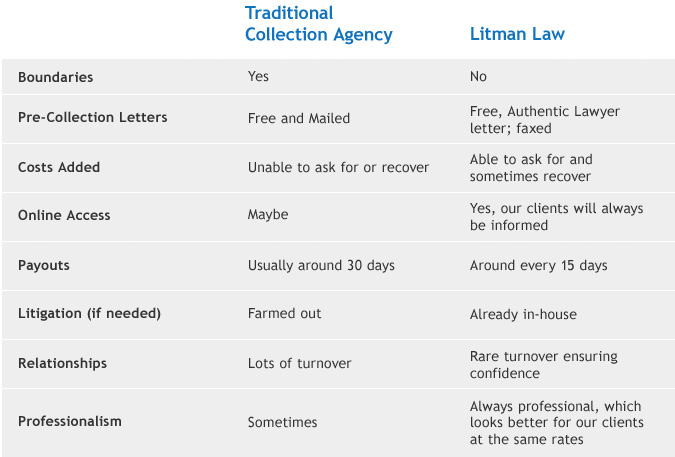

Litman Law offers our clientele a unique and advantageous collection strategy in comparison to a standard and traditional collection agency.

We have analyzed every aspect that we feel is crucial to successful recovery and by doing this we have significantly improved our client’s chances to become a debtor’s priority. The following are four key reasons why Litman Law is the solution to your collection needs:

- Rates and Legal Representation– Litman Law provides client representation of a Law Office at comparable rates to that of a traditional agency. The use of a lawyer presents a far more serious situation to the debtor, creating and maintaining the sense of urgency that is critical to a successful collection;

- Pre-Collection Letter – A pre-collection letter is a fairly standard feature offered by third party collectors. Litman Law offers our client one that looks more professional and is free of charge. As always, there is no commission on payments made during the 7 day pre-collection period. Our client always gets a copy of this letter for their records. Another significant difference with our Pre-letter are that we fax it to your debtor ensuring prompt receipt and providing ample time for recovery without being billed a fee.

- Costs – If the pre-collection letter is not successful, we actually gain more leverage and create a higher sense of urgency by having the ability to ask for costs over and above the principal balance. Collection agencies are unable to ask for anything other than the principal balance owed to their client. Demanding costs opens up negotiation leverage, virtually eliminating lowball settlement offers. In about one in five mattes we are actually able to collect most of our clients’ costs. In other words our client has two reasonable opportunities to gain conclusion by way of payment essentially without paying a fee (pre-collection letter stage or if we collect costs over and above the principal balance). This particular feature of our design is one of the main reasons clients willingly switch from their third party collection agent to our offices and end up staying clients for many years.

There are many other advantages we have designed to benefit our client, such as faster payouts on trust monies received, user friendly online software where our client can track their accounts and we work without boundaries, meaning we can recover accounts worldwide. Our goal is to improve on every aspect of third party recovery by taking advantage of our capabilities and executing on them to recover accounts assigned to our office.

Below shows a comparison chart between our design and a traditional third party.

The Importance of Timing when Placing Your Account

The collection system at Litman Law is built to provide credit granters with the best opportunity to ensure that they are the top priority of their client. The purpose of this article is to outline the importance of timing when placing a delinquent account Litman Law.

The Risk

Why is it so important to place your collection account with us at the proper time? When an account becomes a slow payer, there are undoubtedly other creditors who aren’t getting their money either. It’s up to our client to make sure they are a priority in payment from their client, and consequently giving themselves the best possible chance at recovery.

The Solution

Litman Law provides our client with the best chance to become the paying priority. Placing your accounts at the proper time with our collection department will ensure your priority. However, it’s up to our client to decide and understand the best time to place their accounts. The professionals at Litman Law will work with each client to determine this timing.

As mentioned in the heading, timing plays a huge role. Each industry is different. For instance, in the wholesale clothing business, a normal time to be worried about payment may be at the 120 day mark, whereas in the food supply industry, the 14 day point is where trouble can be spotted. If our client can take advantage of the system we have created, they will significantly lower their bad debt year after year and jump to the front of the line ahead of other creditors.

One of our main tools for determining the state of the account with your client is our free pre-collection demand letter. Our client can write or call often, but our faxed authentic lawyer’s letter will tell our client all they need to know (see Pre-Collection for further details). There are only two possible results…either our client is paid (with no commission on payments received during the 7 day pre-collection period), or our client just realized for free that there are no monies available and immediate and stronger action is necessary.

The Take-Away

Many well-known companies who use our services precisely as designed have been tremendously successful in reducing their write-off’s. They have built an in house system that properly times the account transfer which gets adhered to and is never strayed from. If our client can spend the few minutes it takes to strategize with our office, they will no doubt realize how effective our system can be in moving your business into your client’s top payment priority. When it comes to being paid a little bit of work will go a long way.

How to Ensure your Company Gets Paid – A 4-part checklist

In today’s fast paced business environment and tough economy, it is more important than ever to ensure that your company is paid for goods or services provided. That’s why it is essential that every business establish and follow a structured methodology to extending credit and following up on problematic clients.

The following 4 part checklist, contains a series of recommendations that will assist your company with minimizing bad debt.

1) Before the Sale

a) Establish your system for invoicing, accounting and billing. This involves drafting appropriate, industry specific contracts setting out the primary terms of your relationship with the client. An essential component of this step involves training your team to operate the system in a consistent and reliable manner.

b) Research your client – This step involves qualifying the debtor. Credit checks and trade references can be particularly helpful in properly informing yourself. You should also take a good look at the history of your client’s business.

2) Sale of Goods or Services

a) Document the sale – make sure you send your invoices and obtain signatures. Evidence of delivery and receipt is essential if a problem arises. If possible, make sure the person signing has authority to do so and confirms the goods or services are in the agreed upon state.

b) Protect your interests – when appropriate, obtain guarantees and security. Get a deposit and ensure payments are made on a timely basis.

3) After the Sale

a) Keep on top and follow up – always watch for warning sign such as late payments or NSF’s. Other signs of trouble can be returned mail, a full voicemail box, e-mails bouncing back, websites going down, or a disconnected phone or fax machine.

b) Document your correspondence – as much as possible, keep notes and records of your correspondence. Try to get responses in writing from your client by e-mail, fax, regular mail or otherwise.

4) Mitigate Losses and Act Decisively

a) Send your internal demand letter – do no let a debtor continuously delay. Set a date for final payment, and stick to it.

b) Cut off the customer – stop providing supplies or services until your invoices have been brought up to date;

c) Call in the professionals – if all else fails, send the debt to a thirty party to collect on your behalf.

Developing a system around these steps will provide your business with the best opportunity to get your company paid for the goods and services provided.

Business Registrations Before Initiating Operations

Starting up a business can be a daunting task for the new business owner. It is essential that Ontario business operators are aware of the various registrations required prior to initiating operation.

The 9 basic registrations that are required are:

- Business Number;

- GST/HST Account;

- Payroll Deduction;

- Import/Export Account;

- Corporate Tax Account;

- Vendor Permit Number;

- Employer Health Tax;

- Workplace Safety and Insurance Board; and

- Non-Resident Account.

Most required registrations can be done quickly and easily online at the Canada Revenue Agency website (http://www.cra-arc.gc.ca/tx/bsnss/tpcs/bn-ne/bro-ide/menu-eng.html).

Methods of Carrying On a Business – Should I Incorporate?

In Ontario, there are many different ways to organize a business. The choice of what form of business entity you will choose depends on several different factors and their relative importance to you. From the cost of starting the business, to matters liability and taxation, the choices you make when establishing your business will impact every aspect of your venture going forward.

This article will concentrate on the most common methods of establishing a business, which are the Sole Proprietorship, the Partnership and the Corporation.

Sole Proprietorship

The sole proprietorship is the most basic form of carrying on a business. It is relatively simple and inexpensive to establish, and requires few legal formalities. As the name implies, a sole proprietorship is owned and operated by a single individual and excludes the participation of other individuals, except as employees.

All benefits of the sole proprietorship such as assets and profits accrue to the individual owner, and all obligations including losses and liabilities are likewise the responsibility of the sole proprietor. This preceding aspect of the sole proprietorship brings us to the primary disadvantage of this business vehicle – unlimited personal liability on the owner. Any obligations of the business are personal obligations of the owner of a sole proprietorship. Accordingly, all business and personal assets are at risk of being seized in satisfaction of liabilities of the business.

Income or losses of a sole proprietor will be calculated in the aggregate with any income or losses of the owner from other sources during the year. Accordingly, a sole proprietorship allows a business that is losing money to offset those losses against income received from other sources.

Partnership

A partnership is established when two or more persons carry on a business together with a view to profit. Like a sole proprietorship, a partnership is relatively simple and inexpensive to set up and there are few required legal formalities required to create. Also like a sole proprietorship, the partnership is not a separate entity from the partners. Accordingly, liability attaches to the individual or corporate partner and is unlimited. The exception to this is if a limited partnership or limited liability partnership is established.

An essential component to a partnership is that each partner must rely on the other partner for all business decisions that need to be made. One partner’s actions binds all the partners. From major capital purchases to selection of employees, the decision making process in a partnership is essential to the operation of the business. It is always prudent in a partnership to have a formal understanding of the terms of business and to build protections for the various partners in case of disagreement or dissolution of the partnership. This is generally accomplished through the drafting of a partnership agreement with the assistance of your lawyer.

Taxation of a partnership is similar to a sole proprietorship in that it is the individuals and not the entity that is taxed. Income flows to the individual partners who pay income tax on all income earned from the partnership in addition to other income earned by the individual. In a similar vein, losses incurred by the partnership can be used to offset income earned from other sources.

Corporation

The most frequently used business entity to carry on commercial activities is a corporation with a share capital. Distinct from the business structures already mentioned, a corporation is a legal entity separate from its owners. The corporation is able to carry on business, own property, possesses rights and can incur liabilities all of which are not those of the shareholders.

The corporation is created under provincial or federal statute by registration of the Articles of Incorporation. Once created, it continues to exist in perpetuity and can only be dissolved by resolution of a special majority of shareholders.

One of the most beneficial aspects of a corporation is protection it affords to its owners. Shareholders only have limited liability. The shareholders are said to have limited liability because their liability in connection with the property or business owned by the corporation is limited to the value of the assets they have transferred to the corporation in exchange for shares in the corporation. Liabilities of the corporation do not extend to the individual shareholder unless the shareholder has guaranteed to pay its debts.

Because a corporation is a legal entity separate from its shareholders, a corporation’s income is determined and subject to tax separately from that of its owners, the shareholders. A corporation’s net income is subject to tax each year. If any of the corporation’s after-tax income is to be paid to its shareholders, this is accomplished by the directors declaring a dividend to the holders of the corporation’s shares.

Which Method is Best

No one method is best for every case. When deciding what business vehicle is appropriate in your particular situation, you must consider a number of criteria and their respective importance to you including liability, the number and relationship of proprietors, borrowing requirements of your organization, costs, flexibility requirements, income tax and several other important issues.

Professional Corporations – Process and Benefits

For more than 10 years, the Province of Ontario has allowed regulated practitioners in several professional industries to operate as Professional Corporations. From doctors and dentists to lawyers and veterinarians, the process of incorporating has conferred countless tax and non-tax advantages on professionals. This article will discuss the incorporation process, structure and tax benefits of professional corporations.

Incorporating

Operating a professional corporation is the preferred method of operating a business for professionals (see the article “Methods of Carrying On a Business” for a discussion of the different business vehicles). Once incorporated, the professional has created a separate entity which they can control, but which is independent from the professional for income earning purposes.

The process of incorporating a professional corporation can be both complicated and time consuming. Generally speaking, each professional corporation is governed by both the Ontario Business Corporations Act and a piece of legislation that governs their particular industry. These pieces of legislation impose a series of special rules and restrictions, some of which include:

- Restrictions on who may be the director and officer of the corporation, as well as who may own various classes of share of the corporation;

- Direction regarding what names are permissible for the professional corporation to operate under;

- The general requirement of professional corporations to obtain a Certification of Authorization from the respective governing body;

- Imposing personal liability to the professional for all professional matters relating to the practice; and

- A limitation to the types of business activities that the professional corporation can carry on.

The Minute Book will need updating on a yearly basis. A Corporate Information Act Form 1 must be submitted to the Ministry of Small Business and Consumer Affairs and a Certificate of Renewal must be obtained annually from the regulating organization.

Tax Benefits Available

The primary advantages and reasons of incorporating a Professional Corporation are income tax related. A corporation is taxed at a lower effective rate than an individual. Many professionals are taxed at a rate in excess of 46% whereas a corporation is taxed at 18.6%. Although this lower tax rate applies only to money left behind in the professional corporation, the preferential tax rate allows for efficient uses of these after-tax dollars. Professional Corporations also generally allow the professional to income split with family members by paying dividends, which themselves are taxed at a lower rate (note that there are some exceptions to this depending on the professional’s industry).

If the incorporating professional is already in practice, they will need to transfer the assets of their practice to the Professional Corporation. This is generally done through an Asset Purchase Agreement. The Practitioner can obtain a promissory note equivalent to the tax basis of the assets, which can be considered a shareholders’ loan, if the practitioner is taking ownership of shares.

The Small Business Capital Gains Deduction is triggered when shares of a “qualified small business corporation” are sold. The first $500,000.00 of the sale proceeds are not taxed where non active business assets do not substantially exist. Prior to initiating a sale of shares, this asset holding test should be canvassed.

The Professional Corporation is a tremendously useful vehicle in aiding the professional by providing an alternative means of conducting business and tax benefits. To make proficient use of the advantages of the Professional Corporation, proper planning needs to be performed by the professional in conjunction with their lawyer and accountant.

Collection of a Foreign or Extra-Provincial Judgment

Enforcement of a Foreign, Extra-provincial or International Money Judgment

The purpose of this article is to summarize the legal process required to enable an Ontario court to recognize as valid and thus allow for the enforcement of, a foreign (meaning: extra-provincial or, international) money judgment.

Is Your Judgment Enforceable in Ontario, Canada?

A foreign judgment is prima facie enforceable in Ontario, Canada if it meets the following three criteria:

- the judgment originated from a court that had jurisdiction under the principles of private international law as applied by Canadian courts;

- the judgment is final and conclusive in the original jurisdiction; and

- the judgment is for a definite and ascertainable sum of money, or if not a money judgment, its terms are sufficiently clear, limited in scope and the principles of comity require the domestic court to enforce it.

Defending the Enforceability of a Foreign Judgment

If the foreign judgment satisfies these criteria, it may be recognized as valid and enforceable in Ontario, Canada, unless the respondent convinces the court to the contrary. Canadian law limits the defences that may be advanced in the enforcement of a foreign judgment. The following defences may be used to challenge the enforceability of a foreign judgment:

- the judgment is based on a penal, revenue or other public law of the foreign jurisdiction;

- the judgment was obtained by fraud;

- the judgment was issued in circumstances that deprived the Canadian defendant of natural justice; or

- the judgment violates Canadian public policy.

Steps to Take to Enforce a Foreign Judgment

In Ontario, a foreign judgment creditor has to commence a lawsuit to recognize, as valid and enforceable, a foreign (extra-provincial or international) money judgment. An action of this kind is typically commenced by issuing, with the Ontario Superior Court of Justice and, then serving, on the foreign judgment debtor, who is resident in Ontario, with a Notice of Application. The Application Record will have to include affidavit evidence that will detail, with supporting exhibits, the judicial process undertaken in the foreign, extra-provincial or international jurisdiction, that led to the judgment.

Although discussed mainly for background, the merits of the foreign action are not the focus, but, rather, the judicial process is what is central for the Ontario Court to scrutinize. As discussed above, a prescribed legal test will have to be met by the Applicant or foreign judgment creditor, in order to persuade the Ontario Court to recognize the foreign money judgment as valid and enforceable in Ontario, as if it were a judgment made by the Ontario Court.

In addition to mandatory affidavit evidence, a Factum (statement of facts, issues and law) is required to be filed by the Applicant. The judgment debtor will either appear and respond to the Application (using the limited defences available), or not. Either way, the Application will come before a hearing to a Judge of the Ontario Superior Court of Justice. If and when the Court recognizes the foreign judgment as valid in Ontario, enforcement, on the now Ontario judgment, is the next complex step.

Statute of Limitations in Ontario – Know Your Limits!

Test content

A Primer on Construction Liens in Ontario

Test content